China’s progress toward greater global influence is undeniable and multidimensional, but whether this translates to becoming the “next world leader” depends on how “leadership” is defined. Here’s a balanced analysis based on current trajectories (as of mid-2025)

Areas Where China Is Gaining Ground

- Economic Reach

- Largest trading partner for 140+ countries.

- Dominance in green tech (solar, EVs, batteries), critical minerals, and digital infrastructure (5G/6G).

- Initiatives like the Belt and Road Initiative (BRI) expand infrastructure influence across Asia, Africa, and Latin America.

- Diplomatic & Institutional Influence

- Leadership in multilateral groups: BRICS expansion (Egypt, Ethiopia, UAE, etc.), Shanghai Cooperation Organisation (SCO).

- Mediation roles: brokered Iran-Saudi détente, Ukraine peace talks.

- Expanding UN agency leadership (FAO, ITU, ICAO).

- Soft Power & Cultural Appeal

- Confucius Institutes in 150+ countries.

- “China Model” appeal to developing nations: infrastructure-driven growth, state-led development.

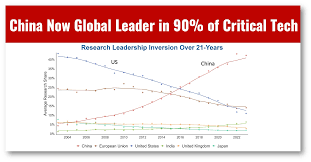

- #1 in global patent filings, STEM graduates, and R&D investment parity with the U.S.

- Global Public Opinion

- Favorability rising in Global South (e.g., 80%+ approval in Pakistan, Kenya).

- Democracy Perception Index (2025): China viewed more positively than the U.S. in 70% of surveyed nations.

Critical Challenges & Limitations

- Economic Headwinds

- Property crisis, local debt (>$13T), and deflationary pressures.

- Declining FDI (-20% in 2024) and “de-risking” by Western firms.

- Demographic decline: population peaked in 2022; workforce shrinking since 2015.

- Geopolitical Friction

- U.S.-led tech/trade restrictions (semiconductors, EVs).

- Regional tensions: South China Sea, India border disputes, Taiwan.

- “No Limits” Russia partnership alienates Europe.

- Institutional Gaps

- Limited global trust in governance: ranks low in Transparency International’s CPI (65th in 2024).

- No military alliances comparable to NATO.

- Currency: Renminbi still only 3% of global reserves (vs. USD at 58%).

- Innovation & Ideology

- Tech self-reliance goals hampered by semiconductor restrictions.

- “China Model” faces skepticism in democracies over human rights, IP protection.

Realistic Trajectory: Co-Leadership, Not Hegemony

- By 2035: China likely becomes the largest economy (nominal GDP), but per capita GDP remains 1/4 of U.S. levels.

- Influence will be regionally dominant (Asia) and sector-specific (tech, trade, climate), not globally all-encompassing.

- A “multipolar world” is emerging: U.S. retains military/currency leadership; EU regulates tech/trade; China leads in infrastructure and manufacturing.

Conclusion

China is poised to be a world leader—especially economically and diplomatically—but not the singular global hegemon. Its rise will reshape international systems (trade, climate, development finance), yet structural constraints and Western pushback prevent outright dominance. The 21st century will likely feature competitive coexistence between U.S.-aligned democracies and China-centered networks.

Sources: IMF, World Bank, UNCTAD, Pew Global Attitudes, Mercator Institute for China Studies, Rhodium Group.